Digital signature for TDS TRACES

TDS TRACES is a web-based application of the Income Tax Department. It offers an integrated interface to all stakeholders related to the TDS (Tax Deducted at Source) administration such as challan and statement status view, refund request submissions, justification report, Form 16/16A, Form 26AS, etc.

The IT Department is taking measures to ensure smooth online return filing for the taxpayer. Therefore, now they can easily sign their TDS and Income Tax returns digitally using the DSC.

The Income Tax Department developed an advanced system called ITD e-filing DSC Management Utility to enable digital signing of the online returns. This utility system enables taxpayers to digitally sign and file their online returns with respect to TDS, Income Tax, etc.

Digital signature for TDS TRACES

Step 1: Go to the Income Tax e-filing website. Click on downloads. Then click on DSC Management Utility and download the file.

Step 2: Extract the zip folder. Open the utility file and read the instructions given below.

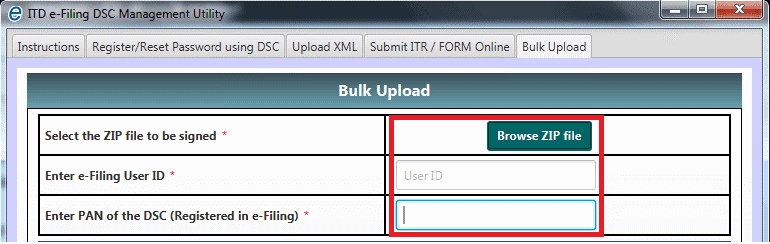

Step 3: Click on 'Bulk Upload'. Then browse and upload the zip file to be signed and enter the e-filing User ID (TAN number) and PAN number.

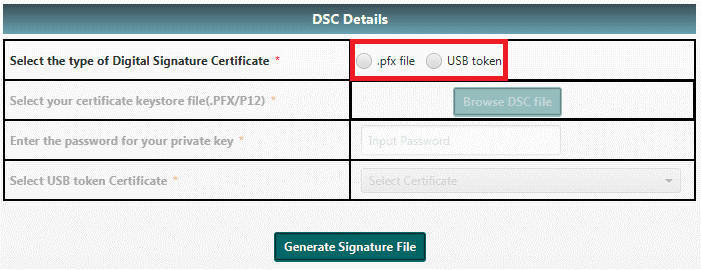

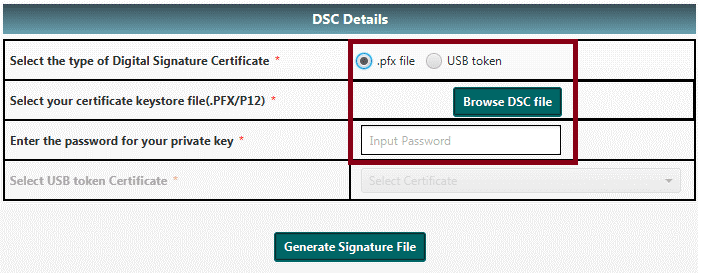

Step 4: Select the type of digital signature certificate - .pfx file or USB token.

Step 4.1: With .pfx file - Select .pfx file from the options available. Then browse the DSC file and enter the password. Click on 'Generate Signature File' at the bottom and save the signature generated. Now upload the signature file along with the return file in the e-filing portal to complete online return filing using a digital signature.

Step 4.2: With USB Token - Select USB token from the options available. Then select a certificate from the drop-down menu and enter the USB token pin. Click on 'Generate Signature File' at the bottom and save the signature generated. Now upload the signature file along with the return file in the e-filing portal to complete online return filing using a digital signature.

Benefits of Using Digital Signature for TDS TRACES

Here are some of the benefits of using digital signature for TDS TRACES:

- Secure and authentic online transactions

- Easy filing

- Eradication of fraud activities

- Time and cost reduction

If you are looking for digital signatures for TDS filing from a Certifying Authority in India, then eMudhra is the right choice for you. As India's largest and most-trusted Certifying Authority, we provide you with the best digital signature services to suit your requirements.