How to register DSC on GST Portal?

Any individual who is registered as an authorized signatory of a company on the GST portal is allowed to sign and file the GST returns using digital signature. Businesses can buy digital signatures from Certifying Authorities like eMudhra.

To avail the e-filing services, taxpayers must register their DSC on the GST portal. Before trying to register DSC on the GST portal you need to have the following:

- Valid Class 3 DSC along with USB Token

- Installed DSC software

- User ID and password to login

Follow these steps to register DSC on the GST portal:

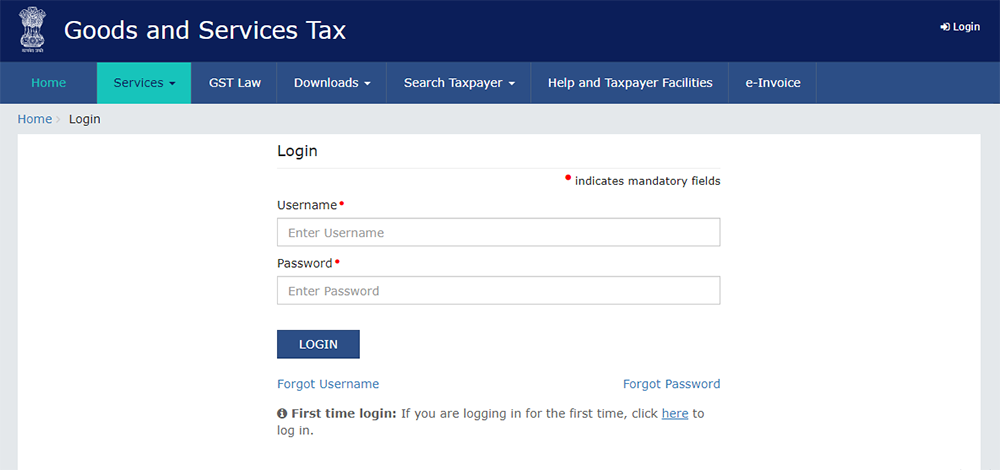

Step 1: Enter the GST portal and click on 'Login' on the top right panel.

Step 2: Enter your username and password and proceed to 'Login'.

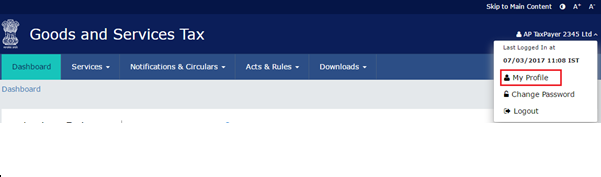

Step 3: Click on your profile name and select 'My Profile' from the drop-down menu.

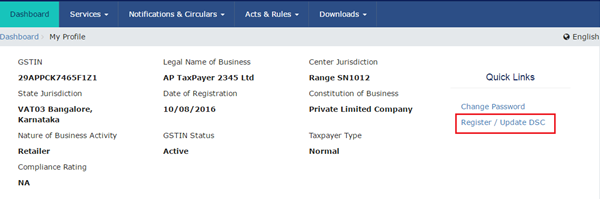

Step 4: Select 'Register / Update DSC' from the My Profile section.

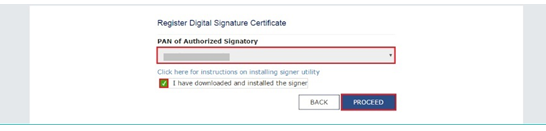

Step 5: Select the authorized signatory that you wish from the 'PAN of Authorized Signatory' drop-down list. Then select the 'I have downloaded and installed the signer' and click on 'Proceed'.

Step 6: Choose the DSC and click 'Sign' to complete the process of registration. This will display a message showing 'Your DSC has been successfully registered'.

eMudhra, being the largest Certifying Authority in India, can provide you a digital signature certificate for filing your GST returns. Digital signature services from eMudhra help you easily file GST returns online.